Back-to-school shopping can be pricey, but the Florida back to school sales tax holiday gives parents a much-needed break.

Let’s be real—back-to-school shopping adds up fast. Between school supplies, clothes, and tech, it’s easy to feel overwhelmed. Thankfully, the Florida back to school sales tax holiday is here to help.

Save Big on School Supplies During Florida’s Tax-Free Holiday

This sunshine state perk lets you skip the sales tax on essentials, saving you money when it matters most. Whether you’re new to this event or just need a refresher, we’ve got your back. Keep reading to learn the Florida tax free weekend 2025 dates, what qualifies, and how to make the most of it.

What Is the Florida Back to School Sales Tax Holiday?

Every year, Florida families get a break from state sales tax on essential school items.

The Florida back to school sales tax holiday lets us shop smarter and save money when it matters most.

This state-wide event is designed to ease the burden of school shopping—and as a Florida mom, I’m all for that!

We’ve used it every year since my oldest started kindergarten. One year, we stocked up on notebooks, pencils, and even a calculator—all without paying a dime in tax.

If you’ve got more than one kid to shop for, those savings really add up!

What does the tax holiday include?

The Florida school supply tax holiday typically covers:

- Backpacks and lunch boxes—always a must in our house!

- School supplies (like folders, crayons, glue, and paper)

- Clothing and shoes priced under a certain amount

- Electronics such as tablets or laptops (if within the price limit)

If you shop online or in-store, you’ll get the same tax break—as long as the retailer follows the rules.

Why should families plan for it?

Because if you’re like me, school shopping can get overwhelming (and expensive) fast.

However, during this tax free school shopping Florida weekend, you can breathe easier.

We always sit down the week before with the supply list, set a budget, and map out where to shop.

That small bit of prep helps avoid last-minute stress—and keeps us focused on what really matters: getting our kids ready to learn, grow, and thrive in the new school year.

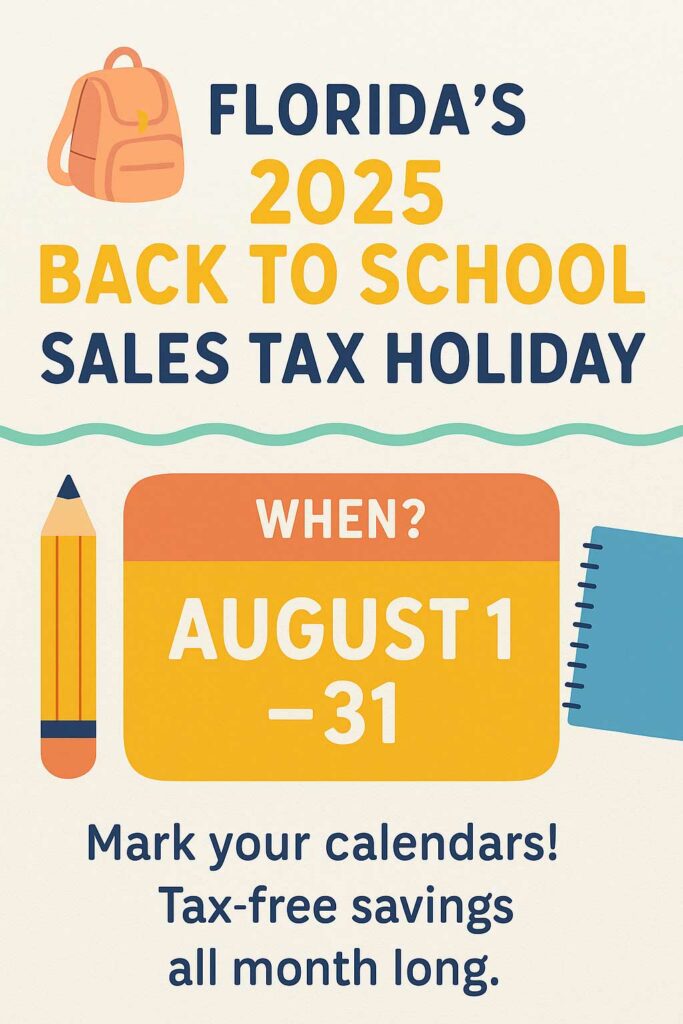

When Is Florida’s 2025 Back to School Tax-Free Weekend?

The Florida tax free weekend 2025 isn’t just a weekend—it’s a full month!

From Friday, August 1 through Sunday, August 31, Florida families can shop tax-free on back-to-school items.

This extended holiday gives us more time to plan, compare prices, and avoid the last-minute rush. If you’ve got kids in multiple grades (like I do), this flexibility is a huge win.

Key Dates to Remember:

🗓️ Start Date: August 1, 2025 (Friday)

🛍️ End Date: August 31, 2025 (Sunday)

⏳ Total Duration: 31 days of tax-free shopping

We usually start with school supplies and clothing early in the month.

Then, we save electronics and extras for when more store sales kick in mid-August.

If you wait too long, though, popular items might sell out—so it’s best to shop in waves.

I always set calendar reminders so I don’t forget the start and end dates.

So mark your calendars, Florida mamas! The Florida tax free weekend 2025 is the perfect time to save while getting your kiddos classroom-ready.

What Items Are Eligible for the Tax Holiday?

The Florida sales tax exemption covers a wide range of school essentials—but not everything qualifies.

So, before you hit the stores, make sure you know what’s included.

This helps avoid surprises at checkout (been there, done that!).

| Category | Qualifying Items | Price Limit | Notes |

|---|---|---|---|

| School Supplies | Notebooks, pencils, folders, glue, scissors, calculators | $50 per item | Everyday supplies are included, stock up early |

| Clothing & Shoes | Shirts, pants, socks, underwear, uniforms, backpacks | $100 per item | Athletic gear, jewelry, and accessories not included |

| Electronics | Laptops, tablets, printers, monitors, keyboards, e-readers | $1,500 per item | Smartphones and gaming consoles do not qualify |

💡 Not Covered: Sports equipment, watches, phones, luggage, cosmetics, and musical instruments

How to Maximize Your Savings During Florida’s Tax-Free Holiday

The tax free school shopping Florida event is a great way to save—but it helps to plan ahead.

Without a strategy, you might miss deals or end up with a cart full of non-qualifying items.

Start by shopping early. If you wait too long, the most popular items—like backpacks, lunch boxes, and uniforms—tend to sell out fast. I learned that the hard way a few years ago when we couldn’t find a single composition notebook the week before school started.

Next, stack your savings. Many stores offer their own discounts and digital coupons during the tax holiday. If you combine those with the state sales tax exemption, you can walk away with serious deals. Always check store flyers or apps before heading out.

Before you buy, review return policies. Some stores limit returns during sales tax holidays, especially on electronics. If you’re buying a laptop or new shoes, make sure you can exchange them if needed.

Create a shopping list in advance. I always start with the school-issued supply list, then match it up with what’s tax-free. This helps us stay on track, avoid unnecessary extras, and stick to our budget.

Finally, bring the kids. It may take longer, but it turns shopping into a hands-on lesson in budgeting and value. My daughter loves comparing prices, and it’s helped her understand how far a dollar really goes.

When you combine preparation with flexibility, Florida’s tax-free school shopping becomes less stressful and a whole lot more rewarding.

Make the Most of Florida’s Tax-Free School Shopping

The Florida back to school sales tax holiday is a great way to stretch your family’s budget.

Even small savings on notebooks, clothes, and tech can make a big difference—especially if you’re shopping for more than one child.

If you plan ahead, shop smart, and take advantage of store deals, you’ll get even more out of the tax-free weekend Florida event. Personally, I treat it like a mini back-to-school tradition. We grab coffee, shop with a list, and turn it into a memory, not just a task.

Remember, this tax holiday lasts the whole month of August, so there’s time to get what you need without the rush. But if you want the best selection, start early and pace yourself.

Every dollar saved now adds up later—on lunches, field trips, and all the little things that come with a new school year. Have a favorite back-to-school deal or shopping tip?

Drop it in the comments or tag @the_coffee_mom on Instagram—I’d love to see what you scored!

FAQs About Florida’s Back to School Sales Tax Holiday

Qualifying items include school supplies under $50, clothing and shoes under $100, and electronics like laptops under $1,500.

In 2025, the Florida back to school sales tax holiday runs from August 1 through August 31.

That’s a full month of tax-free shopping on eligible back-to-school items.

Yes. Online purchases qualify for the exemption if the retailer is located in Florida or charges Florida sales tax.

Items must be purchased and shipped during the tax holiday to apply.

Yes, as long as each item is $1,500 or less and used for educational purposes.

This includes laptops, tablets, e-readers, printers, and certain accessories.